Mission

The State Office of Risk Management will provide active leadership to enable State of Texas agencies to protect their employees, the general public, and the state’s physical and financial assets by reducing and controlling risk in the most efficient and cost-effective manner.

Philosophy

The State Office of Risk Management will act in accordance with the highest standards of ethics, fairness, accountability and humanity for both our customers and our employees. Customer service is a cornerstone of our mission.

Programs & Services

The State Office of Risk Management is charged by Chapter 412 of the Texas Labor Code to administer insurance services obtained by state agencies, including the self-insured government employees workers’ compensation insurance program and the state risk management programs.

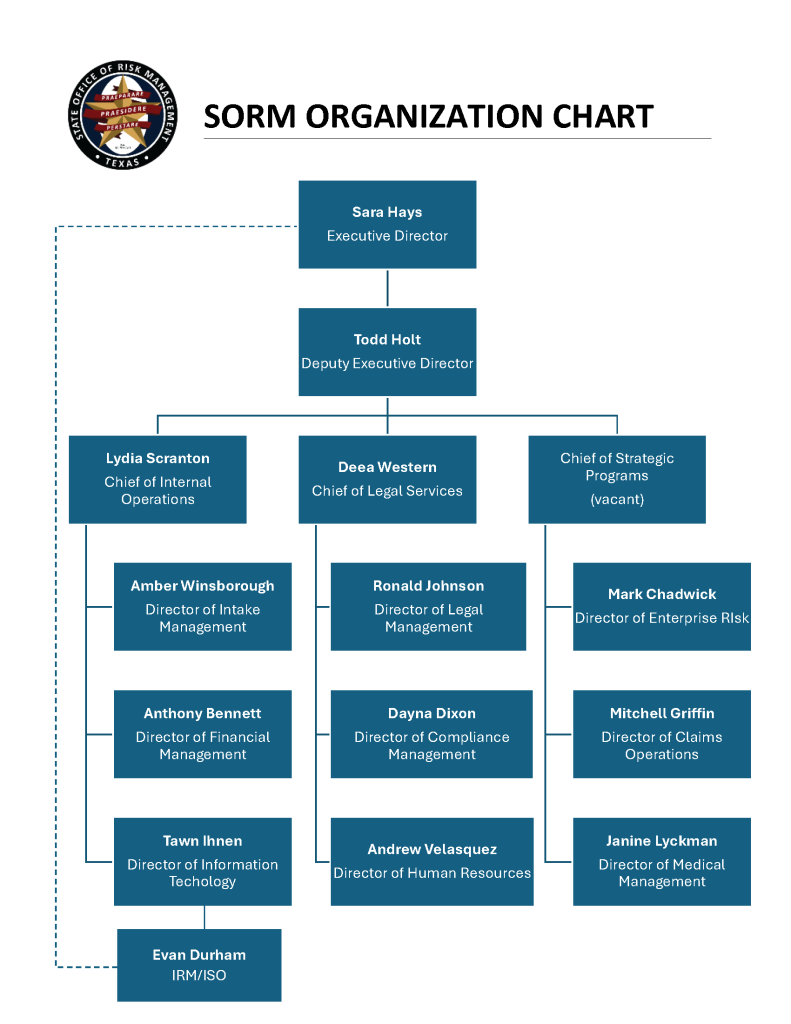

The Office is administratively attached to the Office of the Attorney General and is governed by an appointed Board of Directors. Daily operations are overseen by the Executive Director, as the Risk Manager for the State of Texas. The agency consists of four internal divisions: Executive Administration, Strategic Programs, Legal Services, and Internal Operations.

Executive Administration

The Executive Administration Division is comprised of the Executive Office.

The Executive Office provides strategic and operational oversight for the agency.

Strategic Programs Division

The Strategic Programs Division consists of three departments: Claims Operations, Enterprise Risk, and Medical Management. These departments collaborate to effectively manage the potential risks faced by client state agencies.

The Enterprise Risk Department specializes in enterprise risk management and insurance services for client agencies. Risk Management Consultants at SORM assist state agencies in establishing and maintaining risk management programs aimed at protecting state employees, state assets, and the public. Additionally, Insurance Consultants at SORM develop and administer insurance programs that help transfer the financial risk of the state, providing consultative insurance services to our clients. The Enterprise Risk Department is also responsible for developing and managing a return-to-work program.

Claims Operations encompass the processes involved in the adjudication and management of claims for work-related injuries or illnesses, including claim investigation, medical treatment, and benefit payments and reimbursements. Claims examiners handle all aspects of the claims process as required by law and policy.

The Medical Management Department ensures that injured employees and their providers receive timely payments of appropriate medical care payment or reimbursement for work-related injuries or illnesses. This is often achieved through managed care networks and treatment guidelines while also addressing potential disputes and ensuring compliance with Texas law.

Legal Services Division

The Legal Services Division is comprised of three departments: Legal Management, Compliance Management, and Talent Management.

The Legal Management Department is responsible for presenting and directing SORM’s position during various administrative dispute resolution processes. Legal Management also monitors and assists the Tort Litigation Division of the Office of the Attorney General when it represents the agency in administrative and judicial proceedings. Legal Management is also responsible for recovering workers’ compensation benefits, medical costs, and other expenses paid on behalf of state employees injured in the course and scope of employment due to the negligence of a third party. Special investigations investigates and reports workers’ compensation fraud committed by system participants.

The Compliance Management Department focuses on compliance with statutory reporting and reviewing, and updating of existing policies and procedures. In addition, the department manages contracts, customer complaint/ethics, and open records functions. They also provide legal and policy assistance for agency-wide issues, as well as decisions that affect covered state agencies. They track relevant legislation and work with executive management on proposed rules and legislation.

Human Resources serves as a liaison between SORM and the OAG-HR division on human resource issues. They are responsible for recruiting and retention of staff, compliance with labor and employment laws, processing personnel actions, and ensuring timely leave accounting.

Internal Operations Division

The Internal Operations Division consists of three departments, including Financial Management, Intake Management, and Information Technology.

Financial Management processes and issues approved workers’ compensation medical and indemnity payments to claimants and medical providers, including the cancellation, re-issue, and correction of warrants. This department also administers the assessment program which allocates the amounts to participating state agencies for the costs of operating the agency, including processing workers’ compensation claims. Financial Management provides all accounting and budget functions for the agency in coordination with the Office of Attorney General (OAG) Accounting and Budget Divisions.

Intake Management is responsible for the initial setup and data entry of injury claims received, as well as the maintenance of all inactive claim files.

Information Technology maintains agency systems and interfaces; monitors and provides data; and oversees and responds to security issues. The support staff conducts all agency hardware and software maintenance; monitors software licensing; maintains user access; maintains passwords; and interfaces with OAG ITS. Project management within IT is responsible for overseeing all agency projects and initiatives providing a framework to manage and evaluate project workflow.

Operations & Funding

The Office receives no General Revenue appropriations, carries no reserves, and is financed wholly through interagency contract. This funding program allocates an assessment, like a premium, to all participating agencies based on relevant factors as identified by the Board. To date, this methodology has substantially reduced the total cost of the program to the State.

The average cost of the FY12 state assessment was $.60 per $100 payroll, compared to $1.38 per $100 payroll for other carriers in Texas (TDI, 2012)

Cost Savings & Efficiencies

For FY 2012:

- 21.5% reduction in injury frequency rate since FY02

- 43% reduction in annual workers’ compensation expenditures since FY03

- 53% reduction in final assessment per $100 of payroll since FY02

- 70% reduction in medical billing to actual payments in FY12

For FY 2014: 24% of eligible agencies participating in the property insurance program